DiGi KGB – Info and Selfie App is a ‘Business’ category app listed on Google Play Store. The developers have rated it fit for use by age 3+. This application can be downloaded for free from the Google Play Store without any in-app purchases either. The app requires a minimum of Android OS 6.0 and up. The latest version of the app is v 1.4. It was launched on 26 August 2020.

Opening a new savings account can be quite a tedious task. You need to visit the bank with a list of documents and then wait for the procedure to get covered. This sometimes prevents people from opening a bank account. That is why a new system has been initiated to facilitate citizens with easier options for opening an account. A system of selfie bank accounts has been started.

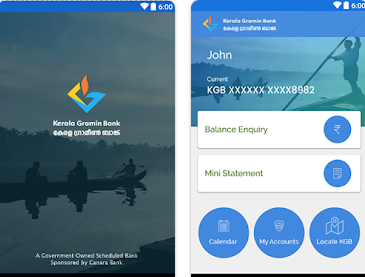

Here, the citizen can open a bank account in two simple steps using the prescribed application: Upload a selfie of yourself and Upload pictures of your Aadhaar Card. The DiGi KGB app is the prescribed application for the Kerala Gramin Bank. It can help the users to: Open a selfie savings account, Access the m-Passbook of all their bank accounts, and many more bank and finance-related activities

The DiGi KGB app is developed by Kerala Gramin Bank. The Android app size is 7.1 MB. 226 users have given this app an average rating of 2.9/5. The number of downloads for DiGi KGB is 500,000+.

Pros of the Application

- You can instantly open a savings bank account simply by uploading a selfie and pictures of your Aadhaar Card.

- This app gives you access to a real-time mini statement, passbook, and balance information for all your existing accounts. Thus, functioning as the complete m-Passbook.

- The Passbook can also be downloaded and saved on the device for offline access.

- The app gives you a special feature of adding remarks on your passbook. Thus, you can note down some important info right in the passbook which you otherwise might forget.

- The app provides you with the locations of nearby active branches and ATMs by using your device’s location.

- You can calculate the interest for all your fixed deposits, recurring deposits, and cumulative deposits according to the current interest rate.

- The app even allows you to calculate the EMI data for your loan requirements.

- You can also find a bank holiday calendar in the app. Thus, you can know when to not visit the bank.

Cons of the Application

The app is a great choice overall with a swift easy-to-use interface. However, unlike other similar apps in the market, it does not have payment options.

Function

A unique selling point of this app is its butter smooth interface and consequent hassle-free user experience. It is a holistic application that serves most of the needs of a banking application. However, it does not provide options for transactions. If that can be inculcated into it, the app would be one of the most successful ones of its kind. Another outstanding aspect of this app is that Kerala Gramin Bank is the first rural bank in India which has developed an application for selfie bank accounts and m-Passbook options. The application is developed very efficiently and thus remains mostly bug-free. This allows all the users to benefit the maximum from this application. However, a few users have reported some complaints in regard to an unsuccessful registration process.